Introduction

Banks and paperworks have a history longer than most of us can think of. If regulations were coffee, banks would be hitting the multiple of them every morning just to keep up. Between constantly shifting compliance requirements and the constant fear of risk, it often seems more like a surprise test taken every single day.

But these tasks are now much easier to tackle as AI risk & compliance automation intelligent systems can automate multiple tasks of compliance and it even never gets tired, never forget to update the policy and most assuredly do not complain about updating it to the spreadsheets.

Let’s discuss today, how AI risk & compliance automation in banks can detect suspicious transactions, identify risks, and stay current with evolving regulations on the fly.

What is AI Compliance in banking?

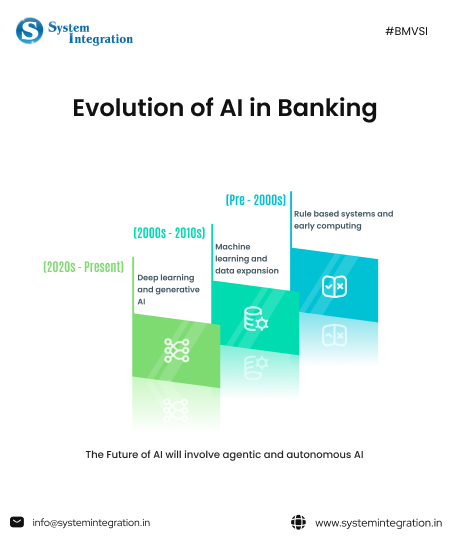

AI in Banking compliance helps banks to fulfill their regulatory obligations accurately and more quickly. In place of simply manual checks or rigid rule based systems, banks now using AI workflows to process their transactions, evaluate risks, study customer data, and check conformance with regulations like

- AML

- KYC

- data privacy

Depending on historical data and regulatory trends, compliance systems driven by AI can learn to know the new risks, cut down on false positives and automate routine compliance work. This not only enhances regulatory accuracy, but also enables banks to reduce operating expenses.

What are the new risks and threats to banking compliance?

1) AI financial fraud: using machine learning to develop more complex investment cons and create genuine, new identities (deepfake ID).

2) Quickly evolving regulations: With multiple new global regulations, it is challenging for banks to keep up with compliance in real time.

3) Third party and vendor risk: Relying on cloud providers, and third party platforms creates compliance weaknesses beyond the bank’s direct preview.

4) Model risk in AI systems: Bias, lack of explainability and consequentiality and insufficient AI models can cause violations of regulation/audit failure.

5) Data privacy and security risks: More sharing of data on online platforms like digital banking exposes risky situations like data leakage & cyber compliance violations.

Why AI compliance matters?

Quicker regulatory compliance: AI automates monitoring and updates to facilitate bank’s real time compliance.

Minimal Compliance Costs: Eliminate manual efforts, investigations and reduce operational overhead due to automation.

Enhanced risk discovery: AI exposes hidden patterns and growing risks overlooked by rule based systems.

Increased reliability: With AI, the chances of errors reduce and the reliability increases when people accidentally slip up in specific processes.

Increased audit preparedness: Regulatory audits are made easy with real time monitoring and extensive audit trails.

Key Application of AI in Compliance

1) Minimizing false positives

False positives are the biggest challenges in the financial industry and especially in the banking sector. When the number of false positives increases it wastes the time of employees in investigations.

AI helps in detecting these patterns by analysing the vast data provided. It also learns from the patterns beyond just the static rule based systems.

The key application includes:

- AI tools can access multiple variables to provide deeper context on any specific data.

- Unlike rule based systems it can track real time activities for identifying potential risks.

- It also learns from the confirmed alerts and dismissed alerts for more accuracy.

- AI accelerates the identification and verifications during the client onboarding.

2) Reducing the manual labour

AI assists in automating the manual processes which are boring and repetitive to humans like data cleaning and processing and streamlining many regulatory tasks.

The key application includes:

- AI systems can automatically collect, aggregate, and process huge amounts of data.

- Machine learning algorithms automatically generate required regulatory reposts.

- It can scan millions of transactions in real time and identify suspicious activity.

- NLP tools monitor communication for potential miss conduct or compliance breaches.

3) Intelligent document processing

AI is used for the classification of the type of the documents and it also then divides them and sends them into their dedicated folders. Other than that it also does various other tasks like automate data processing, structuring it and cutting the manual labor drastically.

The key application includes:

- With the help of NLP it can understand various data info no matter whatever the format it has.

- Machine learning then verifies the extracted data according to the regulatory requirements.

- RPA is integrated with the AI to automate the entire process freeing the humans to do more productive work.

- After training the AI it learns the regular pattern and detects any type of unregular patterns.

4) Implementing regulatory change management

AI automation can greatly help in banking compliance by automating the entire regulatory change management process, from monitoring new rules to implementing necessary changes and reporting to regulators. This automation process increases the accuracy, efficiency and reliability.

The key application includes:

- Multiple AI tools can continuously scan official regulatory resources using NLP for accuracy.

- It automatically applies the vital regulatory change and also notify the regulators.

- It can identify the necessary gaps or errors in the bank’s policy or products or etc and take the necessary actions.

- Robotic process automation can handle repetitive tasks and lower human dependency.

5) Simplifying Regulatory Compliance

AI automates various tasks like real time monitoring, performing predictive analysis, or risk management. This helps in simplifying regulatory compliance. This shift from the manual processes to automated, proactive systems significantly increases accuracy, reduces costs and helps banks manage financial regulations.

The key application includes:

- Automated monitoring of real time data from the various online sources and reporting it.

- With the help of machine learning algorithms it enhances the anti-money laundering (AML) and KYC processes.

- It scans the workflows and datas available and observes the patterns for the risk management.

- It simplifies the regulatory process by furnishing the clear picture of the potential risks.

6) Preventing AML and Financial Frauds

As the of money laundering and financial fraud get more complex, conventional rule based systems struggle to identify emerging threats. AI enhances both AML and fraud prevention by pinpointing unusual behaviour patterns and adjusting to new types of fraud activity, in real time.

The key application includes:

- AI inspects transaction behavior to find any type of suspicious activity.

- It detects risky patterns that static rules frequently overlook otherwise.

- As AI identifies and priorities high risk alerts, it also cuts down investigation time.

- It uses new cases of fraud to constantly update and refine the model for greater detection accuracy while training at or above decision latency.

AI compliance challenges with actionable fixes

Lack of transparency and explainability

Auditors will want to know that there is a logical basis behind risk scores, alerts and compliance decisions, and a less-than-transparent approach can result in audit failures.

Actionable fix:

Banks must implement explainable AI models and documentation of the model logic, decisions paths and input data.

Data quality and bias issues

Data that is of low quality, incomplete or biased, can directly lead to the inaccuracy of any risk assessment and can be used to reinforce discrimination which raises serious concerns from a compliance perspective.

Actionable fix:

Establish data governance measures, conduct frequent data audits and bias testing. Keep on cleaning the datasets for data fairness and regulatory compliance.

Over reliance on automation

Overreliance on AI without human involvement can lead to missed context judgment, false positives or compliance blind spots. Even regulators still want human culpability in the driver’s seat of decision-making.

Actionable fix:

Take the human in the loop approach to AI: AI should assist, not replace, compliance teams. Create clear responsibilities for human review, escalation and final decision approval.

Summarizing thoughts

AI compliance automation is revolutionizing the way bank leaders keep up with regulation and primarily because AI analytical technology fuels advanced algorithms and automates processes. By replacing the manual and unproductive compliance processes at banks with AI automation.

To unlock these benefits at scale, banks require solutions that are scalable and which contain robust security. For this purpose, always work with the best AI software development company in India. As it furnishes a custom solution for the bank that keeps data secure and works smoothly on any platform.

FAQs

AI improves banking compliance by enabling monitoring automation, processing vast amounts of data in real time, reducing false positive alerts, and uncovering false negative hidden risk patterns, which are frequently missed by traditional rule based systems.

Yes, regulators are increasingly accepting AI-based compliance, as long as they are transparent, explainable, and have strong governance, audit trials and oversight by humans.

The most important areas are AML and fraud detection, KYC and client onboarding, transaction monitoring, reporting to regulators, and assessing the degree of risk.

First, the quality of the data, how adaptable it is with compliance guidelines, how it integrates with existing systems.

Automation tools are available with security controls and compliance capabilities to manage business critical data safely. Plus, you can set up various type of security measures like role based access control, 2 factor authentication and much more for higher security of your sensitive data.