Introduction

Artificial intelligence is one of the most talked about topics in finance. AI is expected to learn and execute more efficient decisions and perform more than routine and repetitive tasks. Researches have shown that AI is already dominating and outperforming humans in some financial corporations. This was aimed to find the profitability of human vs AI approaches in trading and investing in the financial market.

Applying AI and its applications in different AI based trading methods vary according to various financial markets’ stocks and assets. Different time frames and small changes while scaling the AI methods results in different outcomes. Therefore, let’s find out which approach is better in trading human or AI, further in this blog.

Understanding Human Trading and AI Trading

What comes to mind when you think about trading? Humans are glued to screen and tracking stocks and charts and various data, right? Well this is exactly the manual method and also called human trading. It includes humans analyzing each and every stock and other vital information to make a decision.

AI on the other hand is cited and considered in various stages and processes of trading. AI, which can learn, mimic, and develop itself, has recently witnessed rapid growth in finance sectors as it offers AI financial solutions for SMEs. Thus, it can be said that AI applies the intelligence of humans to the software. It would then be used in trading businesses.

Today, where most of the business and also individuals are interested in trading, AI is assisting by gathering the accurate data and assisting in predicting the market. Also the principles of AI have expanded to the financial industries.

The Key Difference Between AI Vs Human Trading

| Factors | AI Trading | Human Trading |

|---|---|---|

| Speed and efficiency | Can act at the speed of light | Need time to analyze and enter trade manually |

| Accuracy and decision making | Accurate and data driven decision | Prone to errors and mistakes |

| Scalability and accessibility | It can approach several markets at the same time | It's almost impossible to keep an eye on all the stocks at the same time and keep a track |

| Data processing | Ability to analyze millions of data at the same time | Limited to personal research and manual analysis |

| Cost | Lower cost of maintenance, once you have installed | Higher on going costs like commission, research and more |

| Consistency | Can perform consistently without being tired | Performance can highly vary based on health, mood, mental health |

Top Ways AI Is Applied In Trade

1) The Predictability Of Stock Price Fluctuations

Predicting the market can be one main reason that there is so much focus on the technology side, especially AI in financial institutions and hedge fund companies. Using AI, many simple and routine tasks that are more time-consuming are processed, taking less time and cost less, and give the employees more time to focus on the more critical tasks and decisions.

2) Discovering Patterns

Incredibly powerful AI agents can crunch almost countless data points in minutes. It means they can also detect historical and replicating patterns for smart trading that are often hidden from human investors.

AI can assess hundreds and thousands of stocks in flashes. Humans are not capable of processing that amount of data or seeing these patterns at the same rate as technology.

3) Predictive Trading Based On Sentiment

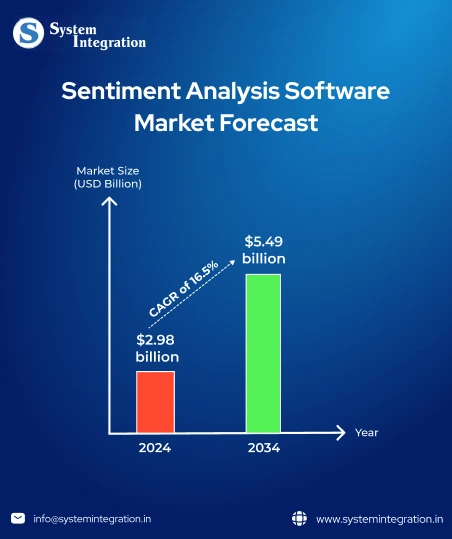

Based on the above figure it can be said that AI is highly used for predicting the sentiment in trading and the market is even expected to rise more. Thus, using sentiment analysis, AI analyses headlines, social media comments, blogs, articles, and more data to find the direction of the stocks and performance or move of other traders.

4) speed Tracking

High speed trading is an unnerving financial market. Algorithmic trading allows financial firms to detect and utilize market movements and patterns at lightning speeds that ultimately result in huge profits.

Will AI Trading Software Outperform Human Traders?

AI’s speed, accuracy, and capacity to analyse vast volumes of data in a matter of seconds are making it a highly reliable source in streamlining finance operations. It is far quicker than a human at identifying patterns, forecasting trends, and making trades.

But even with this quick development, AI still has trouble comprehending complex real world situations where human judgement is crucial, such as abrupt political events, volatile market reactions, or unpredictably occurring global crises.

As a result, trading will not be entirely automated in the future. Rather, it will shift to a hybrid model in which humans make strategic decisions and step in when things are unclear or unstable, while AI manages quick, data driven tasks.

“AI is changing the role of traders rather than replacing them, those who know how to use AI tools will prosper”

Key Technical Requirements for AI Trading

Implementing the trading strategies using algorithms and programming is the final component of trading software. To craft the robust trading software, there are certain requirements that you need to meet:

1) For sensitive predictive analysis and rapid decision making, we definitely need low latency and real time and historic market data.

2) GPUs or cloud computing are required to efficiently train, test and run complex AI models.

3) Techniques such as neural networks, reinforcement learning and time series forecasting underpin pattern recognition and predictive analytics.

4) Ensuring high availability, the security of stored financial data and scalability for increased trading volume.

5) Required for trading automation; updating market data, and syncing AI generator with a live trading account.

The win win scenario

The question”who wins between AI vs Human?” is fundamentally the wrong question and it misframes the reality of the trading market. The real winner is the one who realizes that it’s not the competition and uses the AI finance agent for trading to enhance the trading and bring strength to the table.

As today’s scenario is totally different from the previous times in trading and today those who adopt the AI benefits in trading will surely outperform those who resist it.

FAQs

It depends on the specific market conditions and trading style. AI systems generally outperform humans in high frequency, data intensive tasks due to their speed and lack of emotional bias. Humans however, outperforms AI in unpredictable scenarios when it’s not safe to rely on AI.

Performance varies, but some AI driven hedge funds have reported higher annual returns than their traditional, human managed counterparts. The consistency of AI combined with strategic oversight of humans often leads to more stable and more profitable results.

Yes, having a powerful system or access to cloud based GPU servers is important. Training AI models involves processing large datasets and performing complex calculations, which can take hours or days on a normal PC.

No, historical data is important to train and validate AI models. Without working with previous price actions, the AI is left unable to learn patterns, trial trading strategies or forecast future values realistically.

It is now utilized in various sectors like healthcare, agriculture, cyber security and many more. But the fact is that AI is not perfect and can’t be trusted completely in today’s time.