Introduction

Doing the transaction manually takes up a lot of time and today SMEs are expected to deliver the impossible. Finance operations have evolved to where they are being managed using complex transactions all the way down to risk management and reporting.

It’s easier to automate traditional platforms to make it easier to operate many tasks. AI finance solutions introduce a new era of intelligent, autonomous systems that are not only able to address routine tasks but also the adaptive processes entailing environmental awareness and reasoning.

This can be a game-changer for finance operations by vastly enhancing efficiency, lowering costs, and increasing accuracy at each stage of the financial workflow.

What Is Enterprise Grade Finance Automation?

In simple words, streamlining finance automation can be applied to any digital solution that assists in reducing the unproductive finance tasks and converts into a smooth automated workflow of simplified tech driven operations.

Key Characteristics

Make decisions autonomously without human intervention

- Integrates the data across multiple systems for the authenticity of the finance data

- Extracting and dividing the information into various categories

- Analyzing the patterns to identify the trends, and future demands

- Generating the real time responses to customers related to any finance queries

- Updating the records and account information across every systems

- Processing and tracking of the payments transactions

- Validating the data accuracy across each system

All these functions are performed utilizing various technologies and all the technologies play a vital role in performing all these tasks.

How AI Finance Solution Helps SMEs?

Reduce The Manual Work

AI finance solution cuts many repetitive and unproductive tasks like applying for the loan, queries of customers transaction entry and much more by automating them through finance AI chatbots. As this cuts manual work, the processing time drastically cuts down.

40% Cost Reduction

Through the wide spread of routine task automation, enhanced fraud detection and even more predictive analytics. This efficiency frees the human capital and more strategic work and minimizes expensive errors and processing delays.

Real Time Risk Reduction

By accessing the real time data from the various sources provided, our finance solution can assist in reducing the real time risk. It can analyze the data and make the future prediction for sidelining the potential risks.

65% Faster Decision Making

By faster data processing, it accelerates the decision making processes, also furnishes the real time data to boost predictive analysis. This shift from the manual process to ai driven intelligence significantly enhances decision cycle.

Financial Forecasting

Thanks to the vast portfolio of data pairs with market trends and real time business insights, AI in accounting and finance excels in creating accurate financial forecasts. It integrates real time data from operations, markets, suppliers, and macroeconomic feeds.

They adjust baselines, simulate outcomes, and offer decision makers multiple possibilities, each with projected consequences.

How BMVSI’s Finance AI Agent Delivers For SMEs?

Powered by multi agent intelligence, it acts as personalized assistance that is tailored to understand your queries like complex or simple ones. It then uses real time data available for the accuracy of the data and responds accordingly to each query. It evaluates risks, able to integrate with any existing system, provides actionable insights, all in just a few clicks.

Key Features

- Stack data retrieval

- sentiment analysis

- Comparative analysis

- Real time risk evaluation

- 65% faster decision making

- 2.5x productivity boost

How is it perfect for SMEs?

- It can be easily integrated into any existing system

- Business can start at large or small scale as per the need

- Less risk in decision making as it helps in predicting by evaluating data

- Reduces the manual work and reduce time consumption

- Stays always updated with the latest data

- You can customize the AI finance solution as per your requirements

Challenges And Considerations For Minimizing It

Data Privacy And Security Risk

AI finance systems often require access to large amounts of data of users making them vulnerable for cyber attacks or data security risks.

Solution for it

Apply robust security features and update the digital solution on the regular bases. Limit the amount of data access to AI finance solutions which is necessary for its task performance.

Accuracy Regulation Issue

Financial service providers must deal with the issues of accuracy while deploying a finance Agnetic AI as it needs the data from various systems of the users to analyze it and provide insightful information.

Solution for it

Check and follow rules and regulations also involve the practice of monitoring the data for its accuracy. Following this all practice is vital for user satisfaction.

Unstructured Data

It is crucial for AI finance solutions to manage unstructured data but is also challenging at the same time. As unstructured data can be even more dangerous than no data at all.

Solution for it

Choose the right tools that help in analytics technique. You can implement ML for making data readable. Thus, there will be very less chances of data inaccuracy.

Human Oversight

Solution can manage and operate all the provided data and furnish the accurate results but there are still chances of it making huge blunders

Solution for it

Have human assistance and their accountability. Let the human handle the complex data functionalities

Closure

As AI software development company we believe AI financial solutions are today’s advantage and not a futuristic concept. Agentic AI introduces a new era of intelligent, autonomous systems that adaptive processes entail environmental awareness and reasoning.

Thus, if you are willing to automate your financial workflow and confuse where to start from? Reach out to our experts at BMV System Integration who can help you to automate your financial processes in no time.

FAQs

AI finance solutions are applications and platforms that employ artificial intelligence (AI) to automate financial activities such as bookkeeping, expense management tracking, invoicing, budgeting, cashflow forecasting and financial reports. They assist SMEs in taking data driven decisions and automating manual work.

AI studies spending patterns and income to predict the future of cash flow. It also forecasts delays in payment and proposes actions to ensure you have healthy cash flow like follow-up reminders for late payments.

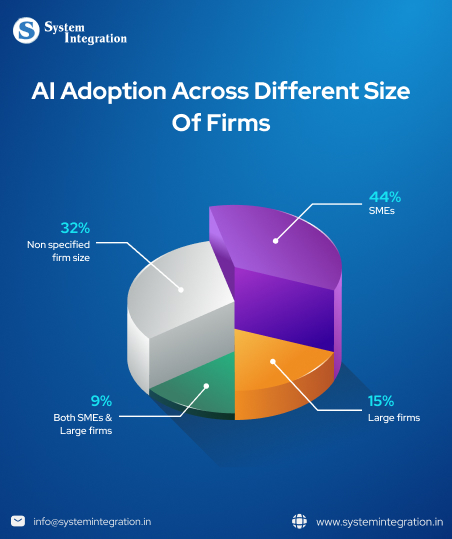

Absolutely, no. while once it was expensive and complex, but now its cost effective and cloud based AI and a user friendly platform available for each size of firms and also you can create your own custom solution for your needs.

AI algorithms use ML and predictive analysis and can verify large data in very less time than traditional methods leading to more accurate financial forecasts.