Introduction

Ever wish the stock market was like a 24/7 customer service desk, except it doesn’t freak out during a market crash or put you on hold when you need some vital information?

That’s exactly what an AI chatbot accomplishes. It’s a smart assistance for trading, allowing investors and traders and accurately calculate the movements of market using real time data, processing details, which helps it process easily.

Everything from simple trading questions to instructions on some trading question, additional visibility of your portfolio and alerts of risks utilize AI Powered Chatbots making trade easier without the human emotions.

in a world where markets never sleep, AI powered trading chatbot gives you instantaneous answers, continuous advice and scalable support. Let’s explore further in this blog, how AI chatbots in stock market support and trading.

What is AI Chatbot for Stock Market?

Stock market AI chatbot is an intelligent virtual assistant that enables traders and investors to smoothly understand the markets, navigate trading tools and get instant answers to questions with real time data and smart analysis.

It is AI and NLP (Natural Language Processing) driven to answer trading questions, explaining moves in the market and helps you make better decisions without human trading involved, as AI trading doesn’t and no need for human support as it’s all done automatically.

Emotional Trading vs AI Driven Trading

| Human Trading | AI Chatbot Trading |

|---|---|

| Fear & greed | Logic & data |

| Slow reactions | Instant insights |

| Information overload | Simplified answers |

Challenges In Traditional Stock Market Customer Support

1. Delayed response times: In periods of high queries of users in the market, support teams are getting overwhelmed. Just a few minutes of delay can result in lost trades and lost money.

2. Restricted availability: There’s only so much a staff member can do during the hours of operation. Stock markets and trading platforms, however, require near real time help.

3. Lengthy wait queues: Traders may find themselves waiting in call or chat queues during times of high activity in the market. This frustration takes a toll on the trust of users in the platform experience.

4. Uneven support quality: The level of response quality varies according to the knowledge of the individual agent. Complex trading expressions are not always treated uniformly.

5. Scalability problems: It’s hard to manually handle spikes in user activity. It isn’t easy or cheap to bring on and train staff quickly.

How Is AI Used In Stock Markets?

AI is already changing the way that stock markets work, however they’re traded and even evolve. That’s because AI has become the immense force accelerating smarter decisions, better predictions and less human error across market to retail trading apps. AI is making it possible for investors and institutions to remain ahead in financial landscape.

Algorithmic & High Frequency Trading

Algorithms, rooted in artificial intelligence, can make trades in the blink of an eye as fast as a few seconds. These applications track price changes, market depth, and historical prices to determine when to buy or sell.

- Why it matters: Faster execution (with the potential for better returns), more liquidity and lower trading costs.

Market Prediction & Price Forecasting

Utilizing past trends, volatility and correlations these models predict prices in the future with more accuracy than normal statistical methods.

- Why it matters: Improving forecasts for financial markets, such as business formation, is crucial in order to make informed investment decisions.

Analysis Sentiment from News & Social media

AI reads financial news, earnings reports, tweets, forums and analyst recommendations to evaluate market sentiment. Sentiment analysis using NLP that often precedes market reactions.

- Why it matters: Traders are getting a look at earlier reactions to markets being moved by emotions and narratives.

Risk Management & Fraud Detection

AI is used to constantly analyse transactions and find anything that could be deemed suspicious in meaning fraud, insider trading or market manipulation. It also can evaluate how risky your portfolio is by simulating thousands of market conditions.

- Why it matters: Decreased losses, increased compliance, and restored market integrity.

Personalized Investment & Advisory

Advisors are AI powered and suggest stocks and portfolios based on investor’s goals, risk tolerance and market environment. These are algorithmic systems that constantly rebalances portfolios of exchange traded funds, come up with individualized strategies as compared to human traders.

- Why it matters: Low cost, data driven advice for democratized investing.

| “Why AI Is a Game Changer for Stock Market Investors Everybody is worried about being left behind in the competitive market, that’s where AI imparts speed, precision and scale to financial markets. It turns raw data into actionable intelligence enabling traders to move more quickly and investors to make better decisions. With markets increasingly jittery and data-laden, AI becomes a competitive edge and no longer something optional but rather necessary.” |

How do AI Chatbots Support the Trading Activities?

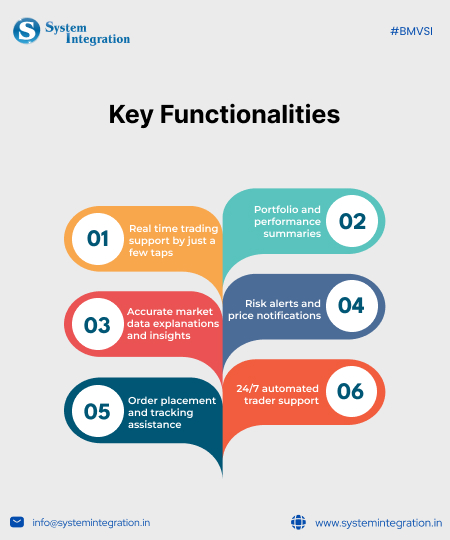

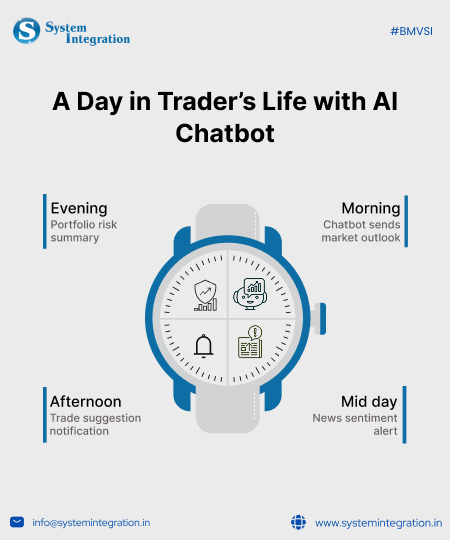

- Market information and news

The chatbot makes all the confusing market data simple to use by explaining current prices, as well as trends, charts, etc. That is useful for traders to take a quick look at what’s going on without having to perform their own extensive technical analysis. - Order placement assistance

With the help of AI chatbots, users are led through the process of placing, amending or cancelling trades. This minimizes trading mistakes and boosts your confidence, especially if you don’t trade often or you’re a beginner. - Portfolio insights

Chatbots can quickly summarize a portfolio’s holdings, profit and loss statements or performance statistics. Traders can follow their investments without clicking on multiple screens or reports. - Instant question answering

AI chatbots reply instantly to trader inquiries about markets, trades or platform functions. This reduces waiting time and enables users to trade profitably when the market is moving fast. - Alerts and notifications

AI chatbots provide real time alerts on price fluctuations, order status changes, and risk levels. This is so that traders are informed even on the side lines. - 24/7 trading support

AI chatbots are available 24/7, throughout market turbulence and even after hours. Such repeated help makes the service more convenient to use and the platform more robust.

Top use cases of AI chatbots in stock trading

1. Keeps eye on market 24/7: AI chatbots consistently monitor stock prices, indexes and market activities second by second. Traders no longer need to stare at charts all day waiting for prices to move, volumes to spike or trends to shift.

- Why it’s powerful

You’re able to stay on top of the markets even when you’re not online.

2. Trading with a Simple Message: Want to buy or sell a stock? AI chatbots are capable of trading straight from your every-day conversation. No complicated dashboards, no manual process just fast, accurate order execution according to your orders or preset rules.

- Why it’s strong

Speed and simplicity in an industry where time is money.

“AI chatbots don’t simply show the market, they interpret it to you.”

3. Smart Stock Suggestions, Not Guesswork: custom AI chatbots pin point technical indicators, historical trading data and live market trends to propose possible trades opportunities. These observations are based on your own risk tolerance and trading objectives.

- Why It’s Powerful

Decisions based on data, not feelings.

4. Turning News into Actionable Insights: With natural language processing (NLP), AI scans headlines, earnings calls, and social media to help you understand news and what the impact of market sentiment will be on individual stocks.

- Why It’s Powerful

Turns real time data into Actionable data

Future of AI Chatbots in Trading and Investment support

Moving from support bots to Decisions Intelligence

Trend:

AI chatbots are transforming from simple support agents to smart decision support systems. The task is also to analyze the market data, trading history and live signals in order to support investment decisions.

Impact:

Traders receive faster, data-driven feedback and are less likely to trade based only on emotions with higher decision quality.

Proactive & Predictive Market Guidance

Trend:

AI chatbots of the future will not be waiting for orders. They will predictively inform users about emerging opportunities, threats and market anomalies.

Impact:

Investors can initiate positions on market changes instead of responding after prices have already moved.

Hyper Personalized Trading Experiences

Trend:

Chatbots are also learning about personal trading habits, risk tolerance level and financial objectives to provide personalized strategies and advice.

Impact:

Every investor gets personalized advice, leading to better engagement, confidence, and long term portfolio performance.

Conversational Trading Interfaces

Trend:

Complex trading dashboards are being replaced by natural language interfaces. Investors can also execute trades, look at their portfolio and ask for advice all through a basic chat.

Impact:

It will open up access to trading, particularly for new and non expert investors.

Unified Access to Financial Ecosystems

Trend:

AI chatbots are being developed as a main interface into trading platforms, market data, news feeds and analytical tools.

Impact:

Less platform switching, higher productivity and a more seamless

Ending words

With the blend of instant analysis, forecasted recommendations and chat based interfaces these AI powered trading bots are faster, smarter and more accessible mannerism of investing. AI driven trading chatbots make investing simple and help overcome emotional and judgment based errors at every level from beginner advice to advanced portfolio monitoring no matter what the market is like.

In this rapidly moving financial market, it would be a great decision to build a custom AI chatbot as per your business goals. And BMV System Integration is the best AI software development company in India for this purpose. As it develops tailored apps for your business which increases scalability and efficiency of your business.

FAQs

An AI trading chatbot is a conversational assistant that offers live market information, opinions and help with trading. It assists you with stock analysis, schedules portfolio events, and organizes ideas for what to do next.

They process vast amounts of data on the market, news and trends to provide quant-based insights. This eliminates trading based on emotions and enhances timeliness & accuracy in decision-making.

Yes, those sophisticated AI chatbots can enter, close or cancel trades on behalf of the user at not only on command but perhaps through predetermined strategies. This will allow faster running and better trading efficiency.

Absolutely. AI chatbots break down trading concepts, strategies and even market jargon in digestible language, demystifying stock trading for the layperson.

The vast majority of AI chatbots adhere to stringent security policies, encryption rules, and regulatory norms. They are made so your data is secured and the trades can be accomplished safely.