Introduction

In a fast-paced industry such as finance, where speed and trust are important, the introduction of AI chatbots is an innovation that has quickly become indispensable. While they can answer simple customer questions, digital assistants are also providing instantaneous investment guidance and changing the nature of how individual savers and institutions tap financial services.

The use of AI chatbots to improve interactions and mitigate the cost of a human workforce is on the rise among banks, insurance firms, start-ups and wealth management companies.

With financial services continuing to digitize, the reliance on AI chatbots will only become more significant. This blog will take a look at the 7 best Finance AI chatbots that are making a great impact highlighting their features, benefits and why they are topping charts in today’s finance world.

What are AI Finance Chatbots?

AI finance chatbots are smart virtual assistants that are tailor-made to serve user queries related to financial services. It replicates human like discussions for customers to engage with financial platforms instantly. They can respond to frequently asked questions, check account balances, process transactions, give spending advice, suggest investment strategies and even warn users they’re up to something suspicious.

In other words, AI finance chatbots are making an ideal mix of automation and intelligence possible so that financial tasks can run both smoothly and quickly while focusing on the customer. So choosing the right chatbot for your business is very vital as they are more than a crutch, they are a business advantage that is transforming how people interact with their money in the digital age.

Why Is It Vital To Have Finance Chatbots For Business?

Assisting Finance Planning

A finance AI chatbot can answer common questions about savings, investments, and personal finance based on the user’s specific financial situation. These bots analyze spending patterns, income and goal to deliver personalized suggestions that help users manage their finances more efficiently.

Fraud Detection And Prevention

As AI has access to a certain amount of data of users, it can access the real time data of them resulting in less chances of fraud as it can instantly detect any kind of suspicious activity.

Cost Reduction

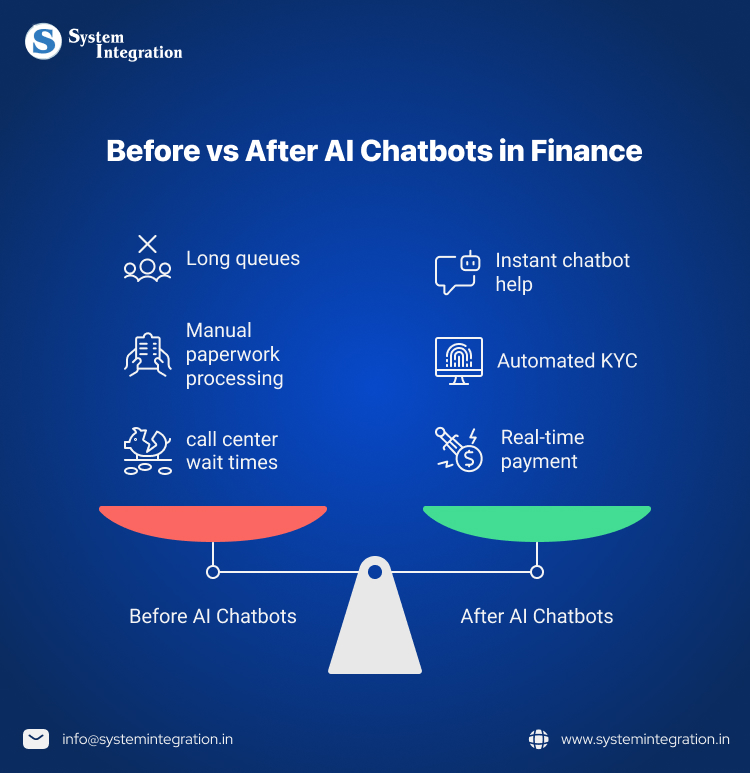

It can definitely assist in reducing the cost by automation of various tasks, which results in less hiring of staff and also decreases the expenses of training humans. Plus the AI can be operated 24/7 and it doesn’t charge any extra for it which reflects in reduction in over time pay.

Enhancing Customer Interactions

By furnishing 24/7 services, personal advice, recommendations as per the user data, easy online loan application fill ups and much more. This leads to better customer engagement and better interactions.

Handles Large Amount Of Data Smoothly

Handling large amounts of data smoothly affects the user experience and makes it better. As a scalable chatbot will effortlessly manage a large user database and still work and respond quickly.

Criteria For Selecting The Best AI Chatbot

Performance of the Chatbot

It is a vital factor in finance for delivering secure, accurate, timely and stable service to build the customer trust and to enhance user experience. As poor performance leads to inaccurate information, transaction issues and many other problems.

How Scalable it is

Finance industries have a high volume of data of users and to handle that smoothly without any kind of glitch or errors, scalability is a vital factor. As a scalable chatbot can effortlessly service thousands of users at a time and furnish accurate service as per user query without any hurdle.

Security and Compliance

In every instance, banks and lenders are the gaurdian of extremely sensitive client data. A perfect AI chatbot must also comply with laws such as GDRP, PCI DSS or such other laws 2. End-to-end encryption, authentication capabilities and fraud detection tools are crucial to keep pace with customer expectations and regulatory requirements.

Advanced Natural Language Processing

The best finance chatbots don’t simply stick to a script they have context, intent, and the ability to interpret financial jargon. Powerful NLP functionality ensures the chatbot can understand complex requests, answer accurately and engage users naturally.

Here are Top 7 Best AI Chatbots in Finances

AlphaChat

AlphaChat develops secure and scalable AI-powered customer service solutions for financial services. Banks and fintechs use it to give their customers instant, compliant, and personalized support – all of which saves them money on support.

Primary Attributes

- Automates the customer asking about account, payment and transaction.

- To provide secure authentication for financial discussions.

- Scales for high frequency interactions with low overheads.

- Facilitates omnichannel delivery via the web, mobile, and messaging apps.

Kasisto

Kasisto is a purpose-built, conversational platform for financial services. It lets banks and credit unions offer digital assistants that have natural conversations with customers on financial matters.

Primary Attributes

- Provides individual financial advice and tips.

- Improves mobile banking with AI and chatbot technology.

- Connects to core banking platforms for instant data.

- It focuses on Agentic AI that can anticipate customer needs

Kore

Kore provides AI based chat interfaces for financial services, enabling clients to reduce friction and increase efficiencies. It is also especially strong at integrating payments and banking processes into chat.

Primary Attributes

- Helps with bill payments, transfers and loan applications.

- Offers multi-language support so that it can be used by more people.

- Leverages AI and NLP to comprehend intricate financial questions.

- Decreases dependency on call centers by providing task automation.

Haptik

Haptik, part of Reliance Jio, is one of the largest conversational AI platforms with millions of users. It enables enterprises to serve frictionless customer support and engagement using AI operated chatbots.

Primary Attributes

- Enables customer onboarding, KYC and lead generation.

- Provides 24/7 assisted automation with human transfer options.

- Goes into CRM, connects to banking systems and gives real time answers.

- Guides user for loan applications and help in online documentation

Microsoft AI

This financial chatbot is trained for simple policy lookup to answering complex enquiry fueled by Microsoft AI, using Azure AI and Cognitive Services. These bots can be customized significantly, which lets banks and fintechs to have enterprise grade solutions across compliance or data security.

Primary Attributes

- Provides natural language understanding with Azure Cognitive Services.

- Provides customized AI models for fraud detection and risk analysis.

- Provides protection for the entire company and meets financial regulations.

- Integrates directly into Microsoft Teams as well as other popular collaboration tools.

ChatBot

ChatBot increases the customer satisfaction rate by furnishing the instant and to the point answers for the specific query. It can also be integrated with multiple channels for online support. Plus, it can even be integrated with live chat and it will work seamlessly together.

Primary Attributes

- ChatBot can be connected to multiple channels

- Proactively shows offers to boost sales

- Allows 14 days free trials when creating an account

- Allows faster issue resolution to each query

Datarails

For all finance related businesses Dararails can act as financial advisor. It configures exactly what users are looking for according to their queries. It has comprehensive insights that are displayed containing all the vital data in easy to understand format.

Primary Attributes

- Its best for knowledge based chat, internal data insights, story boarding

- Its visually appealing reporting makes it best for financial planning

- Its not a clients facing solution like others

- Effortless streamlining of data analysis for easy to understand reports

Wrapping Up

With financial services continuing to digitize, the reliance on AI chatbots will only become more significant. It replicates human-like discussions for customers to engage with financial platforms instantly. After going through the top 7 AI chatbots in finance, it will be easier to pick which is more fitting for your requirements.

However, if you want to build your own tailored AI chatbot, then your search is over. Being the best AI chatbot development company, we have experts who can help you craft the best fitting chatbot specifically for your business which can significantly boost your customer retention and engagement rate.

FAQs

Finance AI chatbots automate customer queries, account management services, and assist with transactions and real-time financial data to cut operational costs and improve client satisfaction.

AI chatbots can easily connect to banking systems, CRMs and accounting programs via APIs in order to share information thus making it simple for the financial sector while also complying with related industry laws.

Yes, sophisticated chatbots do leverage NLP and machine learning to interpret nuanced financial inquiries, deliver accurate advice, and escalate any problems that require a human touch.

Top Finance AI chatbots are end to end encrypted, multi-factor verified and do not store sensitive information while adhering to GDPR, PCI-DSS standards of financial data security.

Return on investment can be measured by reduced response times, lower support costs, higher customer interaction value, improved transaction accuracy and increased client retention rates.