Introduction

In today’s high-speed corporate world finance departments are expected to deliver the impossible. Finance operations have evolved to where they are being managed using complex transactions all the way down to risk management and reporting. Traditional automation platforms have made it easier to automate many tasks, but from the side of decision-making and managing complex processes they still often come up short. And here is where agentic AI in financial services comes to the rescue.

Agentic AI introduces a new era of intelligent, autonomous systems that are not only able to address routine tasks but also the adaptive processes entailing environmental awareness and reasoning. This can be a game-changer for finance operations by vastly enhancing efficiency, lowering costs, and increasing accuracy at each stage of the financial workflow.

What is Agentic AI?

Agentic AI is a term used to describe AI systems that are particularly oriented around operating as autonomous “agents,” and developing the capacity to perceive their environment, make decisions, perform tasks (which may include experimentation based on its own learning), and learn from these events. Agentic AI works as an agent and automates the tasks but is different from AI agents as it does not fully automate the tasks.

These agents can act alone or coordinate with other agents and humans by pursuing particular objectives. While traditional automation tools or rule-based bots (or RPA) stand in stark contrast to Agentic AI systems and do :

- Understand context and intent.

- The business makes decisions based on information available.

- Adapt workflows dynamically.

- Don’t repeat the past, learn from it.

Agentic AI uses machine learning, natural language understanding and autonomous decision-making to perform the task with minimal human intervention.

How does Agentic AI Streamlines Finance Operations?

Automated Invoice Processing and Reconciliation

Using agentic AI, organizations can automatically extract line item data from invoices, compare it to a purchase order and verify the differences without any human intervention.

The AI agent can in turn alert the relevant team or correct itself in case of an anomaly (for example, a pricing error or an invoice duplication based on certAIn rules).

Real-Time Cash Flow Monitoring

AI agents can track transactions and bank feeds in real-time, which allows for an immediate view of cash flow positions. They can foretell future cash requirements, rAIse the flag for any anomalies or guide on the best investment or borrowing decisions in accordance to past trends

Financial Forecasting and Budget Planning

Thanks to the vast portfolio of data pairs with market trends and real-time business insights, AI for financial services excels in creating accurate financial forecasts. It integrates real time data from operations, markets, suppliers, and macroeconomic feeds.

They adjust baselines, simulate outcomes, and offer decision-makers multiple possibilities, each with projected consequences.

Enhances Innovation in Financial Services

AI in finance is enhancing the innovation in financial services by enabling autonomous decision making and execution across various functions, leading to increased efficiency, personalized customer experiences, and new revenue streams.

By automating tasks and streamlining workflows, Agentic AI helps financial institutions reduce operational costs and improve productivity.

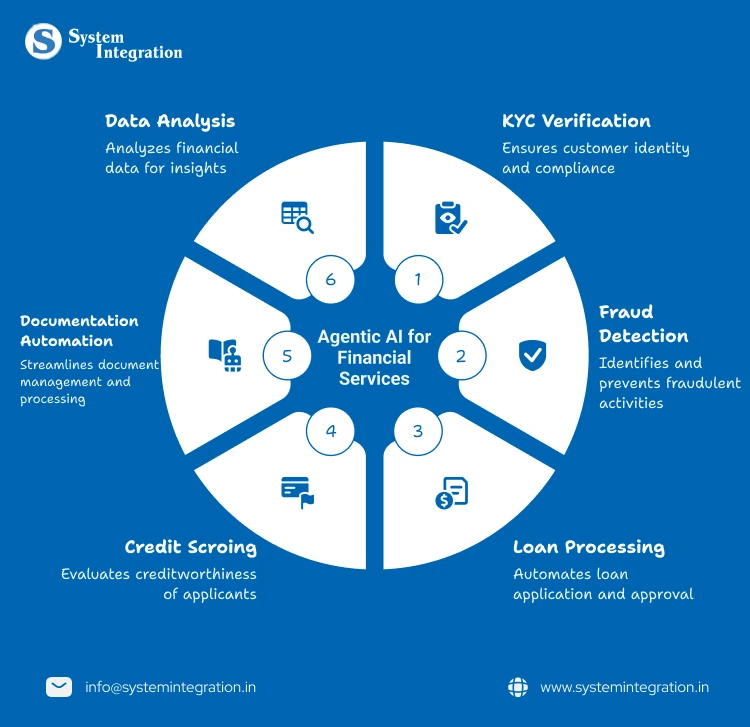

Key Use Cases of Agentic AI in Financial Services

Key Use Cases of Agentic AI in Financial Services

KYC(Know your customer)

Agentic AI facilitates regulatory compliance by automating monitoring and reporting processes. This compasses anti-money laundering(AML) and know your customer(KYC) initiatives, where AI systems quickly detects any kind of suspicious activities and ensure adherence to regulatory requirements and standards.

Fraud Detection

When it comes to fraud detection, Agentic AI is a far good option as it performs better than traditional tools. As it helps in detecting hidden risks like fake vendors, duplicate invoices, or unusual payment patterns or suspicious transactions.

Loan Processing Automation

AI in finance helps by providing real measurable value across finance operations. It processes automation slashes processing time by 88%, with AI agents working alongside loan officers to manage verification, compliance, and approvals in minutes.

Credit Scoring

Agentic AI estimates credit scoring from various available data including their transaction history and market behaviour. Based on this it can make a certain decision. This automation shortens the processing and revert back time from days to minutes.

Documentation Automation

Unlike traditional methods of maintaining data and pulling the specific record out when needed, which requires time. AI for financial services helps in presenting the audit-ready data on demand eliminating the unnecessary time waste and very precise information.

Data Processing And Analysis

The big volume of processed and unprocessed data makes it becomes time consuming and tough to identify the similar pattern and separate the data accordingly. Here comes Agentic AI which does it in a uniform pattern and in very less time.

Plus, analysis by improving efficiency, enabling faster processing and more informed decision making resulting in reducing expenses.

Challenges And Considerations For Minimizing It

Data Privacy And Security

Agnetic AI systems often require access to large amounts of data making them vulnerable for cyber attacks.

Solution for it

- Limit the amount of data access to Agnetic AI which is necessary for its task performance.

Regulatory Compliance

Financial service providers must deal with the issues of privacy regulation while deploying an Agnetic AI system.

Solution for it

- It involves proactive monitoring of regulations.

- Strong data governance practice is vital for data accuracy.

Unstructured Data

It is crucial for Agenic AI to manage unstructured data but is also challenging at the same time.

Solution for it

- You can implement ML for making data readable.

- Pick the right analytics technique.

Human Oversight

Agentic AI can manage and operate all the provided data and furnish the accurate results but there are still chances of it making huge blunders

Solution for it

- Have human assistance and their accountability.

- Let the human handle the complex data functionalities.

Closure

As AI software development company we believe Agentic AI in financial services is today’s advantage and not a futuristic concept. Agentic AI introduces a new era of intelligent, autonomous systems that adaptive processes entail environmental awareness and reasoning.

Want to automate your workflow and confuse where to start from? Reach out to our experts at BMV System Integration who can help you to automate your business processes in no time.

FAQs

Agentic AI in finance can benefit in automation and get to decisions on its own, execute tasks and have learned from data over time on how to manage financial workflows without continual human intervention.

It streamlines various repetitive jobs, corrects data errors, finds anomalies and allows Machine Learning algorithms to be put in place so that the future can be predicted efficiently (e.g., invoicing, budgeting, compliance).

Agentic AI when powered with strong encryption, access control and compliance frameworks can more than deliver on this while processing highly sensitive financial data in a secure and compliant manner.

Some examples are automated expense reporting, fraud detection, cash flow forecasting, tax compliance or vendor payment optimization.